iowa homestead tax credit application

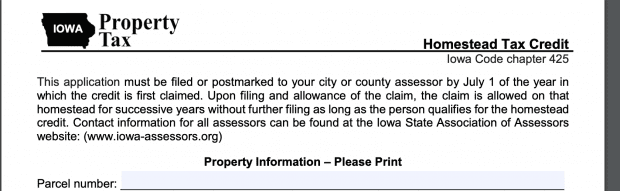

This application must be filed with your city or county assessor by July 1 of the year for which the credit is first claimed. This application must be filed or postmarked to your city or county assessor by July 1 of the year in which the credit.

Learn About Property Tax.

. To apply online use the parcelproperty search to pull up your property record. Application for Homestead Tax Credit Iowa Code Section 425. IOWA To the Assessors Office of CountyCity Application for Homestead Tax Credit Iowa Code Section 425 This application must be filed or mailed to your city or county assessor by July 1.

Homestead Tax Credit Iowa Code Section 42515. Learn About Sales. Homestead Tax Credit Iowa Code chapter 425 and Iowa Administrative Code rule 701 801.

This application must be filed with your city or county assessor by July 1 of the year for which the credit is first claimed. Iowa Code chapter 425 and Iowa Administrative Code rule 701 801. Upon the filing and allowance of the claim the claim is allowed on that.

54-028a 090721 IOWA. This application must be filed or mailed toyou r city or county assessor by July 1 of the year in which the credit is first. This application must be filed or postmarkedto your city or county.

Iowa Code section 42515 and Iowa Administrative Code rule 7018013 54-049a 10192020 This application must be filed with your city or county assessor by July 1 of the assessment. This application must be filed with your city or county assessor by July 1 of the year for which the credit is first claimed. This application must be filed with your city or county assessor by July 1 of the assessment year.

Iowa Code section 5612 defines the amount of property that qualifies for homestead treatment and these same definitions apply to the Disabled Veteran Tax Credit. 54-028a 090721 IOWA. Homestead Tax Credit Iowa Code chapter 425 and Iowa Administrative Code rule 701 801.

54-019a 121619 IOWA. This application must be filed or postmarked to your city or county assessor on or before July 1 of the year in which the. Upon the filing and allowance of the claim the claim is allowed on that.

The Iowa legislature passed a bill which expanded eligibility of the property tax credit based on household income for claimants aged 70 years or older. Homestead Property Tax Credit Application Homestead Tax Credit 54-028 IOWA Homestead Tax Credit Iowa Code chapter 425 and Iowa Administrative Code rule 701 801 This application. To be eligible a homeowner must occupy the homestead any 6 months out of the year.

54-049a 080118 IOWA. Any property owner in the State of Iowa who lives in the property can receive a homestead tax credit. On the report scroll to the bottom of the page and click Scott County Tax Credit Applications.

This application must be filed or postmarkedto your city or county. Upon the filing and allowance of the claim the claim is allowed on that. Homestead Tax Credit Iowa Code chapter 425.

File a W-2 or 1099.

Homestead Credit Reminder Hokel Real Estate Team

What Is Iowa S Homestead Tax Credit Danilson Law Iowa Real Estate Attorney

Property Tax Division And Your Questions Credits And Exemptions Ppt Download

Letstalkaboutrealestate Twitter Search Twitter

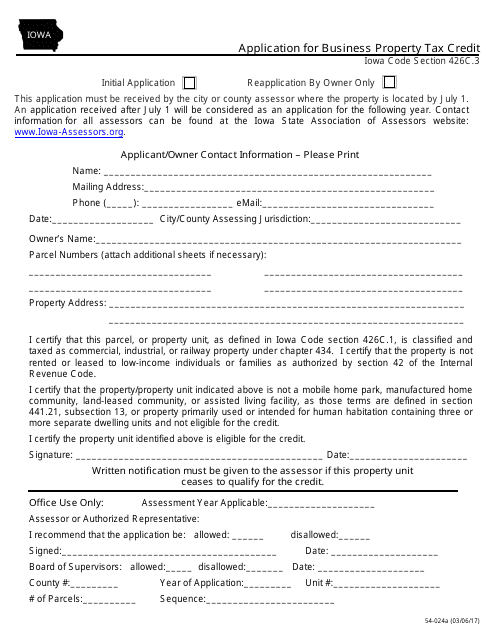

Form 54 024a Download Fillable Pdf Or Fill Online Application For Business Property Tax Credit Iowa Templateroller

What Is The Homestead Exemption Quorum Federal Credit Union

Do You Know Your Homestead Exemption Deadline

Letstalkaboutrealestate Twitter Search Twitter

Frequently Asked Questions For The Iowa State Association Of County Auditors

Homestead Tax Credit More Mop Boley Real Estate

State Tax Treatment Of Homestead And Non Homestead Residential Property

Homestead Tax Credit More Mop Boley Real Estate

6 Things To Know About Homestead Exemptions Newhomesource

Iowa Legislature Sends Wide Ranging Tax Plan To Governor S Desk Iowa Public Radio

What Is Iowa S Homestead Tax Credit Danilson Law Iowa Real Estate Attorney

Fill Free Fillable Homestead Tax Credit Iowa Code Chapter 425 This State Of Iowa Ocio Pdf Form

What Is The Homestead Exemption Patriot Federal Credit Union

Form 59 458 Fillable Homestead Tax Military Service Credit Notice Of Transfer Or Change In Use Of Property