lakewood co sales tax online filing

This is the total of state county and city sales tax rates. Return and payment due on or before January 20th each year.

Taxes Governments Finance Their Expenditure By Imposing Charges On Citizens And Corporate Entities Tax Debt Relief Tax Lawyer Tax Help

Sales and use tax returns are due on the 20th day of each month following the end of the filing period.

. For definition purposes a sale includes the sale lease or rental of tangible personal property. Businesses located in the Centerra Fee districts sales tax. Sales Use Tax System SUTS State-administered and home rule sales and use tax filing.

All businesses selling goods in the City must obtain a Sales and Use Tax License. Retail Sales Tax A 35 Sales Tax is charged on all sales in the City of Englewood except groceries. Manage My BusinessTax Account password required Online Payment Options.

Municipal CodeSales and Use Tax View the Citys Municipal Code relating to Sales and Use Tax. Sales Tax Return Due Date. File a Sales Tax Return.

The City of Lovelands sales tax rate is 30 combined with Larimer Counties 080 sales tax rate and the State of Colorados 29 sales tax rate the overall total is 670. If you have more than one business location you must file a separate return in Revenue Online for each location. Revenue Online ROL File state taxes and manage your state tax account.

Sales and Use Tax Returns - 2017 and earlier. A fast simple convenient way to file and manage your business taxes with Lakewood Business Pro. License file and pay returns for your business.

The Lakewood Colorado sales tax is 750 consisting of 290 Colorado state sales tax and 460 Lakewood local sales taxesThe local sales tax consists of a 050 county sales tax a 300 city sales tax and a 110 special district sales tax used to fund transportation districts local attractions etc. What is the sales tax rate in Lakewood California. Consumer Use Tax 2011 - Ordinance No.

Businesses that pay more than 75000 per year in state sales tax. The Divisions phone number is 216 529-6620. Lakewood CO 80226 MAIN.

Did South Dakota v. The Finance Director may permit businesses whose monthly collected tax is less than three hundred dollars 300 to make returns and payments on a quarterly basis. FILE AND PAY SALES AND USE TAX ONLINE - 2018 and later.

Colorado Official State. The minimum combined 2021 sales tax rate for Lakewood California is. LAKEWOOD January 04 2021 -- The Colorado Department of Revenue CDOR and FAST Enterprises released an upgrade to the Departments free tax filing and e-services portal Revenue Online on January 3rd.

Learn more about sales and use tax public improvement fees and find resources and publications. The distributor does not collect any sales tax. Businesses with a sales tax liability of up to 15month or 180year.

The Division of Tax is located at 12805 Detroit Ave Suite One Lakewood OH 44107. Sales Use Tax. 300 or more per month.

City salesuse tax return. The Lakewood sales tax rate is. Colorados Tax-Exempt Forms.

Starting September 1 2021 taxpayers who wish to pay their quarterly estimated tax bills online will be able to do so. Filing of Sales Tax Returns Sales tax returns and payments shall be made monthly before the twentieth 20th day of the following month. Sales and Use Tax 2011 - Ordinance No.

How To Get Started. Business A with an office in Lakewood purchases computers from an internet distributor based out of the state. The County sales tax rate is.

Sales tax returns must be filed monthly. Taxpayers may also check estimates file their current years tax return and upload digital copies of their tax documents such as W-2s or Federal 1040 for both the current year and prior years. For assistance please contact the Sales Tax Office at 303-651-8672 or email SalesTaxLongmontColoradogov.

The Colorado sales tax rate is currently. Return forms will not be mailed out by the City. Monthly returns are due the 20th day of month following reporting period.

Did South Dakota v. Colorados Sales Use Tax System. There are a few ways to e-file sales tax returns.

If you are filing online the sales and use tax total due and payable must be paid online using an e-check or credit card. Returns can be accessed online at Lakewood. The Lakewood sales tax rate is.

File and Pay Sales and Use Tax Online. Its latest version utilizes taxpayer feedback to. For additional e-file options for businesses with more than one location see Using an.

Geographic Information System GIS Look up sales and use tax rates by address or map location. Sales and Use Tax 2002 - Ordinance No. After you create your own User ID and Password for the income tax account you may file a return through Revenue Online.

The California sales tax rate is currently. The minimum combined 2021 sales tax rate for Lakewood Colorado is. Download all Colorado sales tax rates by zip code.

Manage your tax account online - file and pay returns update account information and correspond with the Lakewood Revenue Division. Retailers without physical presence in Colorado and businesses with multiple locations in Colorado are encouraged to use. Learn more about transactions subject to Lakewood salesuse tax.

Wayfair Inc affect Colorado. Business Licensing Tax. The County sales tax rate is.

Get information on Accommodations Business Occupation Motor Vehicle and Property taxes in Lakewood. As an alternative to Xpress Bill Pay the City of Lone Tree also participates in Colorados Sales Use Tax System SUTS which allows businesses to file and pay sales and use tax returns. The Divisions fax number is 216 529-6099.

Businesses with a sales tax liability between 15-300 per month. The Revenue Online portal helps Coloradans file their state taxes and manage their state tax accounts for free. This is the total of state county and city sales tax rates.

Sales Use Tax. Historic Preservation Tax 2009 - Ordinance No. You also can visit the Sales Tax Office in the Longmont Civic Center at 350 Kimbark Street.

Return and payment due on or before the 20th of the month following the end of each quarter. Returns can be accessed online through Lakewood Business Pro with an established user account.

Sales Tax Filing Information Department Of Revenue Taxation

Business Licensing Tax City Of Lakewood

Freetaxusa Free Tax Filing Online Return Preparation E File Income Taxes Get 10 Off Their Already Low Price W Free Tax Filing Freetaxusa Income Tax Return

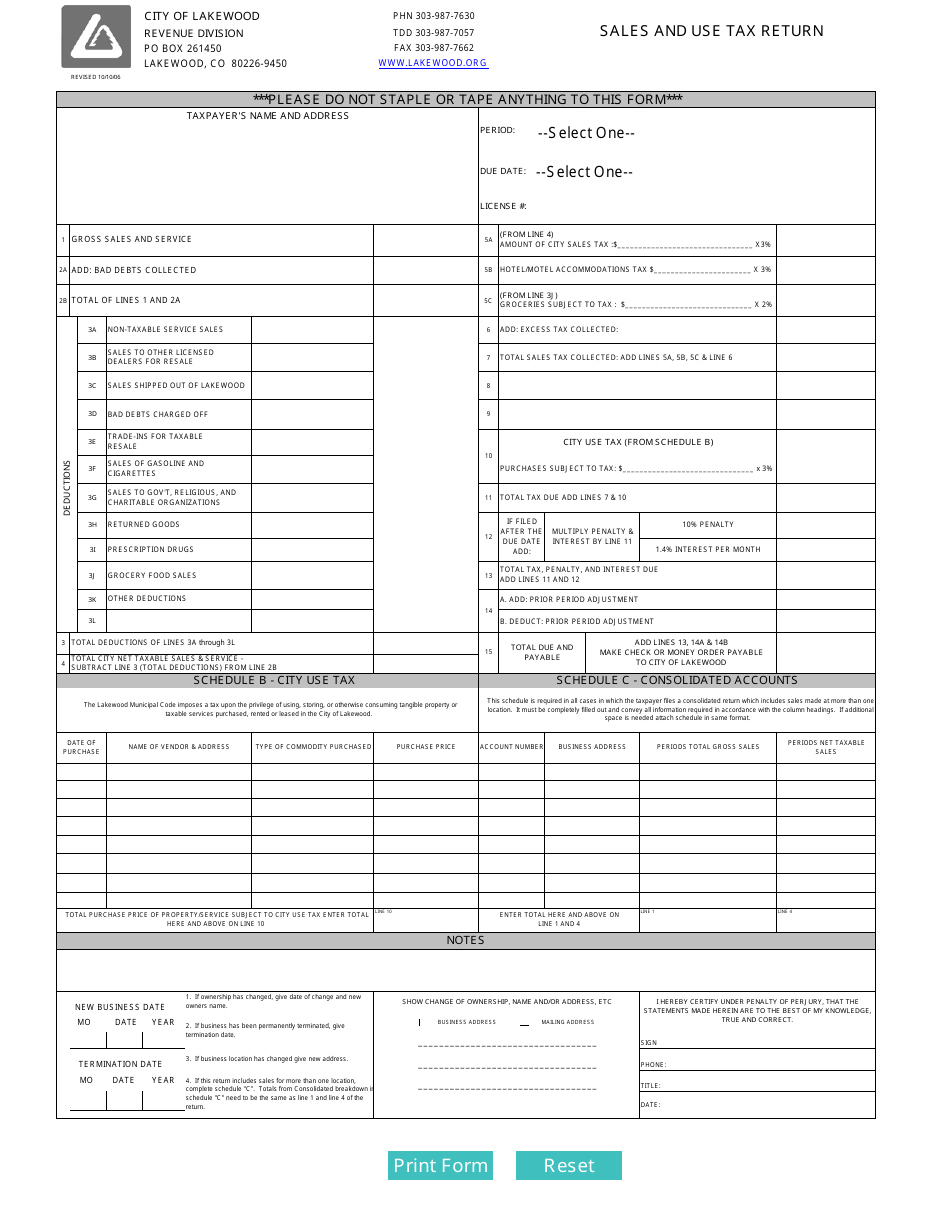

City Of Lakewood Colorado Sales And Use Tax Return Form Download Fillable Pdf Templateroller

Business Licensing Tax City Of Lakewood

Business Licensing Tax City Of Lakewood

Business Licensing Tax City Of Lakewood

How To Organize Your Receipts For Tax Time Visual Ly Small Business Tax Tax Time Business Tax